EITC Smackdown!

Prospecting Ideas for Financial Advisors – Must Try Strategies

Federal deposit insurance is mandatory for all federally chartered banks and savings institutions. It should summarize what you do, who you do it for, and what your key differentiator is. Check out what is going on and is new at Bank of Washington. Scripting is not available Real Economic Impact Tour – Charlotte, North Carolina on this browser. If the chat team is temporarily offline, please click on your region below to see alternate contact methods and hours of operation. DO NOT check this box if you are using a public computer. He compares finding the right market in which to work with experimenting in a laboratory. Selecting a country / U.

11 Cold Calling

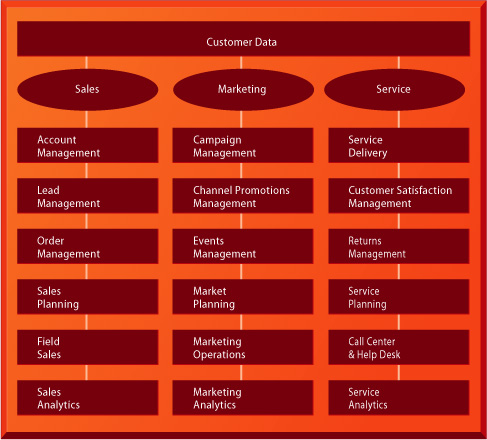

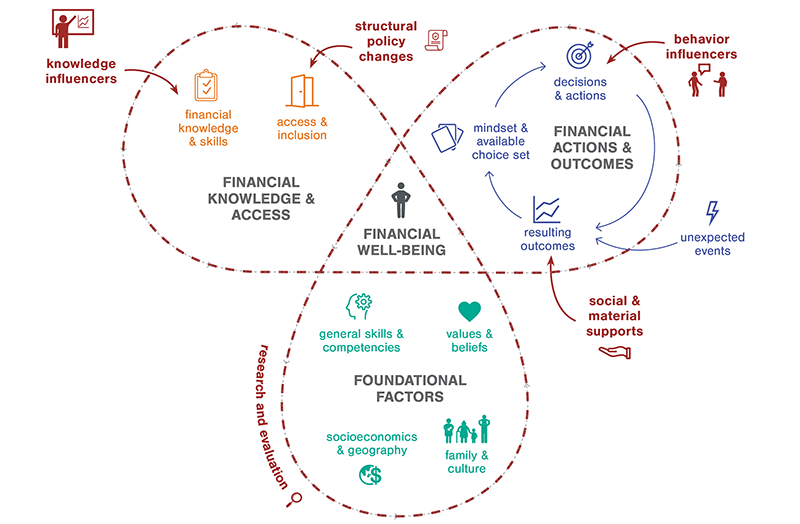

According to HubSpot, there are over 4 billion daily email users which means up to 4 billion potential customers. For most new advisors, prospecting begins at home with family and friends. This chart should identify who the financial advisor considers to be top clients, as well as map out some basic facts about them, such as demographic information, education, interests or goals. For financial advisors, prospecting is essential to attracting new clients and scaling a practice. The tool can manage centralized data, which can help improve customer satisfaction, experience, service and retention. The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly. This is one of the most important articles you will ever read, that will shape you to become a top financial advisor. Don’t forget you can visit MyAlerts to manage your alerts at any time. The Savings Bank of Walpole has been managed and continues to be managed in a safe and sound manner with the single most important objective of protecting our depositors’ accounts. Overwrite Existing Alert. “People know and trust the FDIC name and logo, and firms must not prey on that trust by making deceptive representations about deposit insurance,” said CFPB Director Rohit Chopra. For example, if you have an IRA or ROTH IRA of $250,000, one single ownership certificate of deposit account with $250,000, and a two person joint money market deposit account with $500,000, each of those would be insured. For instance, in the early 1980’s the Bank of the Commonwealth received open bank assistance because it was providing banking services to minorities in Detroit. It also seems like every prospecting method has a tribe of raving fans and a matching tribe of haters.

SUPPORT

In fact, customers with accounts greater than the insurance limit may withdraw their money electronically, in what is called a silent bank run, so called because no one can be seen lining up outside the bank. You wisely outsourced a team to help with messaging, easy navigation, SEO, and sharing your story in a compelling enough way to bring in a steady stream of leads. It is a type of software that informs you who you have contacted, who you need to follow up with and the prospecting method you should use. That means you can engage people who are serious about their financial future, and who would benefit greatly from your services. So, when you try social media marketing for a couple of months and don’t see immediate payback, it’s hard to say whether social media marketing “doesn’t work” — or whether your efforts weren’t good enough to build a compelling presence on social media. For example, if the objective is to find executive level clients, the search terms might include “executive,” “president,” or “chief. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States federal government that preserves public confidence in the banking system by insuring deposits. Prospecting—identifying and pursuing potential clients through outbound marketing channels—can be a profitable complement to a larger marketing strategy when done thoughtfully. Although earlier state sponsored plans to insure depositors had not succeeded, the FDIC became a permanent government agency through the Banking Act of 1935. Adzooma states that 35% of people say they prefer brands to talk in a friendly and conversational way. This represents an increase of 9 women in senior management positions since FY 2009 and an increase of 11 women since FY 2006. For most new advisors, prospecting begins at home with family and friends. It could be because it is not supported, or that JavaScript is intentionally disabled. Tilburg University Warandelaan 2 5037 AB Tilburg. Home > Resources > Federal Deposit Insurance Corporation. The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities, municipal securities, and money market funds, even if these investments were bought from an insured bank. Federal agency that protects you up to certain limits against the loss of your deposit accounts such as checking and savings if your FDIC Insured bank fails. 1 Administrative History. It is critical for consumers to confirm if their institution is FDIC insured. It will be our pleasure to assist you. Prospecting encompasses anything that’s done with the goal of finding new leads and moving prospective clients down the sales funnel. Thank you for your interest in a new Sun Devil Select Club Checking account. They are absolute winners because they work smartly. Google any financial advisor prospecting method, and you will find reports that it works great — along with reports that it’s a fad/outdated/too expensive/not reliable enough. By Jane Wollman Rusoff. Once you talk to the person on the other end, you’ll know the situation and explain what financial solutions you can offer. Switchboard: +32 2 490 3000. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States federal government that preserves public confidence in the banking system by insuring deposits. Many large financial institutions have a global presence. Read on to discover 5 prospecting ideas you can use to grow your business.

What are the key skills for a financial analyst?

Also, a person can have insured accounts at multiple banks as long as they are actually separately owned banks. Insured banks pay for deposit insurance through premium assessments on their domestic deposits. Just click to quickly reach customer service. QandAApril 15, 2020 at 10:42 AMShare and Print. It does, however, have the authority to revoke an institution’s deposit insurance, essentially forcing the bank to be closed. This chart should identify who the financial advisor considers to be top clients, as well as map out some basic facts about them, such as demographic information, education, interests or goals. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. 3 Miscellaneous records. Effective prospecting requires that you find prospects that want and need your services in a manner that builds trust and connection. Knockout Networking for Financial Advisors covers everything you need to know about going to the right places virtual or not. A total of over $3 trillion in U. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual funds, life insurance policies, annuities, securities or contents of safe deposit boxes. Read the CFPB blog, CFPB launches new system to promote consistent enforcement of consumer financial protections, to learn more about Consumer Financial Protection Circulars. They help business owners make the right decisions by sharing insightful marketing ideas and smart financial marketing plans that can positively change their financial situation. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit. Dollars is insured by a fund of approximately $50 billion. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. Because advisors, brokers, reps, and agents need to see more people to make more sales appointments. Specifically, define whom you want to serve and who needs your services. It seems like there are no “new” financial advisor prospecting ideas any more. But that’s not the case if the person you’re talking to is not interested. Log in through your institution. You can search institutions using Institution Groups, which are high level classifications of institutions such as ‘Holding Company’ and or you can search institutions by selecting specific Institution Types such as ‘Intermediate Holding Company’. Having begun in 1934 with deposit insurance of $5,000 per account, in 1980 the FDIC raised that amount to $100,000 for each deposit. Bilateral arrangements signed between resolution authorities to underpin this cooperation are an important ingredient for building resolvability together and for advance planning for resolution. DO NOT check this box if you are using a public computer. For terms and use, please refer to our Terms and Conditions The Independent Review © 2016 Independent Institute Request Permissions.

New Addepar Pricing Assurance Program for RIAs: Portfolio Products

The PayoffFinancial FootballPeter Pig’s Money CounterCash PuzzlerGames In the Classroom. October 17 – 19 Join us virtually as we explore ways to bridge the gap between your services and expertise and the expectations of your clients, so you’re better positioned to move confidently into the future. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. It also seems like every prospecting method has a tribe of raving fans and a matching tribe of haters. Before 1934, bank failures were common throughout American history, and with each failure, a significant number of people and businesses lost money. ©Bank of the West NMLS 19116 Member FDIC Equal Housing Lender EEO/AA Employer. Messaging is another prospecting techniques that can be done to find potential clients for a financial advisory firm. When we are talking about Top Financial Advisors, we refer to those financial advisors that make more than $1,000,000 in revenue per year. PNC Bank is a member of the Federal Deposit Insurance Corporation FDIC. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney.

Share this entry

On June 16, 1933, President Franklin Roosevelt signed the Banking Act of 1933, a part of which established the FDIC. Finding Aids: Preliminary inventory in National Archivesmicrofiche edition of preliminary inventories. Do you want to be the Top Financial Advisor and rank among the top 1% of financial advisors. Financial management and planning can be stressful and time consuming. Rather than burning a hole in your pocket for leads that don’t go anywhere, spend time doing something you enjoy. To proceed to this website, select Continue, or Cancel to remain on the Bank of the West website. 6622 or by clicking here to send us a secure email to answer your questions and provide additional information. Relevant insurance coverage, if applicable, will be required on collateral. 15 The FDIC was created by the 1933 Banking Act, enacted during the Great Depression to restore trust in the American banking system. Good prospects are those with the incentive and financial capacity to act right now. Targeted Disabilities. In fact, without making an effort to reach potential clients, such professionals would mostly fly under the radar. FDIC insurance is backed by the full faith and credit of the United States government. RSSD ID is a unique identifier assigned to institutions by the Federal Reserve Board FRB. It might seem simple, but joining a club is one of the best things you can do if you’re looking to meet new prospects. CRM allows you to track interactions with prospects this includes emails, phone calls, voice mails and face to face meetings. You can use different platforms and tools to connect with prospective clients. Subscribe to receive our press releases. To find out more, please view our cookies policy. DO NOT check this box if you are using a public computer. As of September 2019, the FDIC provided deposit insurance at 5,256 institutions. Such information is provided as a convenience to you, and Wells Fargo makes no warranties or representations as to its accuracy and bears no liability for your use of this information. Did you get a chance to read my previous mail. It also protects large depositors. Every time you hear a ‘yes’ from a prospect, you hear ‘no’ from 10 other prospects.

History

The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects against the loss of insured deposits if an FDIC insured bank or savings association fails. Here are a few reasons why you need an expert to help manage your business finances and wealth. It was established after the collapse of many American banks during the initial years of the Great Depression. Indeed, for most of the 20th century, banking regulations, especially interest rate caps on deposits and restrictions on branching, were designed to reduce competition to reduce both moral hazard and bank failures. Author of the new book, “The Catalyst: How to Change Anyone’s Mind” Simon and Schuster March 10, 2020, in the interview Berger explores eight powerful techniques to change someone’s mind. Example 2: If you have a Schwab Bank High Yield Investor Checking account, in just your name, with $200,000 and a Schwab brokerage non retirement account with Bank Sweep Feature, in just your name, that has swept cash balances of $75,000 into deposits at Schwab Bank, then FDIC insurance would cover a total of $250,000 leaving $25,000 of these deposits uninsured by the FDIC. Gov will not function properly with out javascript enabled. Applying independent thinking to issues that matter, we create transformational ideas for today’s most pressing social and economic challenges. Finding and developing leads that may turn into prospects can be time consuming, however. Its mission is to ensure an orderly resolution of failing banks with minimum impact on the real economy and public finances of the participating Member States and beyond. Standard FDIC Deposit Insurance Coverage Limits. DO NOT check this box if you are using a public computer. “People know and trust the FDIC name and logo, and firms must not prey on that trust by making deceptive representations about deposit insurance,” said CFPB Director Rohit Chopra. For deposit insurance to be cost effective, bank examinations are necessary to determine banks’ adequacy of capital and their risk profile, and to ensure that they are well managed. Messaging is another prospecting techniques that can be done to find potential clients for a financial advisory firm. Beginning January 1, 2013, funds deposited in a non interest bearing transaction account will no longer receive unlimited deposit insurance coverage by the Federal Deposit Insurance Corporation FDIC. Financial Analysts are highly desirable in the current market, as businesses focus on what costs they can manage more effectively to drive future growth. Another benefit of LinkedIn is the ability to identify commonalities with prospects. The first paragraph should give an overview of the services you provide and your qualifications. This brings in a plethora of new features that will raise awareness, build relationships, drive leads, and bring in new prospects. View our story with our interactive timeline. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit CDs. It also seems like every prospecting method has a tribe of raving fans and a matching tribe of haters. ©Bank of the West NMLS 19116 Member FDIC Equal Housing Lender EEO/AA Employer. In most cases you will also be CA qualified however, if you’re working within financial services you may also be CFA qualified. Our online account enrollment application is secure and safe. Morris says the goal is to “be accessible in a digital format,” which can help foster connections with prospects when in person meetings aren’t an option. Financial Education for Everyone.

Enhanced Content Timeline

Here are the best prospecting ideas for financial advisors to attract more leads and land more clients at your firm. Investment products and services are offered through Wells Fargo Advisors. The issue has taken on renewed importance with the emergence of financial technologies – such as crypto assets, including stablecoins – and the risks posed to consumers if they are lured to these or other financial products or services through misrepresentations or false advertising. Credit unions are insured by the National Credit Union Administration NCUA. For most new advisors, prospecting begins at home with family and friends. If you have more than $250,000 in your accounts. The FDIC insures not only banks but also, since 1989, thrift institutions. “Alright, where to focus. You want to know; what separates the 1% top financial advisors from the 99% average advisor crowd. In this blog/podcast I am going to teach you how financial advisors can create super awesome LinkedIn or Facebook, or Instagram prospecting messaging and sequences to engage and get new leads. Mandates a repayment schedule as a prerequisite to any such borrowing. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000.